What comes to mind when you hear the words estate planning? If you think of older people with many assets, you’re not alone. However, it’s a common misconception that estate planning is only something done by people who are old and/or rich. Estate planning is actually for everyone, and the earlier in life you start planning for your future, the better. Creating and implementing an effective estate plan will give you peace of mind and assurance that there’s a plan in place in case you are unable to provide for, or make decisions for, yourself or your family. When you first start the planning process, your plan will likely be fairly basic. As your life progresses, your plan may need to be updated to account for changes in the people and assets in your life, as well as evolving values and beliefs. At The Knee Law Firm, Ltd. we suggest checking in with us about every three years to discuss any major life changes that may impact your plan. Here are some of the main things to consider at each stage of life. Young & Single Even though you may be unmarried and have no children, it’s important to have at least a basic estate plan in place. A staple of every plan is a will, which allows you to dictate who will receive your assets when you die. If you die without a will, a probate court will decide what happens to your assets, costing your loved ones additional time and court costs to resolve things on your behalf. In addition to a will, you might also complete a personal property form, listing your most valuable assets and to whom you wish them to go. A trust is also something you might consider, even at this point, because of the ease with which it allows your trustee(s) to act on your behalf, if needed, and its ability to be easily changed as your life evolves. A trust acts like a bucket for your assets that you can simply pass on to your trustee if needed/when you decide. Unlike the will, the trust is active while you’re alive and provides protections now and into the future. Other key parts of your estate plan should include:

Newly Married/Young Family It's a good idea to add your spouse and any children to your estate plan. Each state has different rules for how your estate is handled in the absence of a will or trust. For example, here in Illinois, half of the estate is distributed to your spouse and the other half is distributed equally among your children. This can complicate things if a home needs to be sold, etc. Having an estate plan in place puts you in control of how your estate is to be handled. If you have minor children, you also have the opportunity to name a person, or persons, to act as a guardian in the event that you and your spouse are no longer able to care for them. If you don’t already have life insurance or long-term disability insurance, now would be a good time to start these policies. If you are unable to support your family due to injury, illness, or death, you will want them to have some support. Additionally, there are various investment plans to choose from when setting aside funds for your children’s education and for your retirement. Later in Life You may be retired or getting close to retiring. If you haven’t already, it’s a good idea to designate/review the person(s) who you would like to make financial and healthcare decisions on your behalf if/when needed. Your estate plan is likely more robust and complex than when you first started it years ago. Aside from your primary residence, you may have other property, such as a vacation home. Passing on your assets to your descendants is something you are likely thinking about. With an estate plan in place, this process can be a much easier and less expensive one for your loved ones. You may also have different ideas about your end-of-life care than you did years ago. Now is a good time to review your estate plan to ensure it still reflects your wishes. No matter your stage of life, it’s never too soon to create your estate plan. Our team at The Knee Law Firm, Ltd. is happy to guide you through the process and create a plan that fits your unique needs. Please feel free to connect with us for more information and an initial consultation.  An Estate Plan is something everyone should have in order to protect your wishes, well-being, and assets at a time when you and your family are at the most vulnerable. The following five documents are essential to your planning and retaining a trusted Estate Planning attorney is the first step in setting these legal guidelines in place. 1. Will The will is a legal document that outlines who receives your assets after death. A valid will is critical for adults to possess regardless of age. It is especially true if you have dependent children since your will identifies guardians for them. Without a will, the courts decide who is responsible for raising your children and what happens to your assets. Each state has statutes that prescribe the formalities to observe in making a valid will. In Illinois, two non-family witnesses are required, as well as a notary. 2. Revocable Trust This type of trust allows you, as the grantor, to amend, add assets to, or terminate the trust for as long as you like or until you can't or no longer wish to manage the trust. You also name a trustee (if married, this is generally your spouse) who will eventually make daily decisions regarding certain assets on behalf of the trust and transfers these assets to beneficiaries upon the your death. Assets in the trust pass outside of a will and outside of probate, thus reducing court fees, delays in asset distribution, and protecting assets from becoming a matter of public record. Your estate planning lawyer can also design your revocable trust to reduce federal estate taxes. Please know ... you don't need to have significant assets to benefit from this trust. A revocable living trust is one of the most important documents for nearly anyone to have in their estate plan. 3. Medical Directives or Advanced Directives This document, also known as a Living Will Declaration is a backup to your Healthcare Power of Attorney and is specific document outlining your wishes for healthcare choices in anticipation of incapacitation, illness, or end-of-life care. For example, some individuals want medically heroic measures to remain alive, while others might opt for a peaceful passing and less invasive care. A medical directive provides clarity and guidance in decision-making for medical teams and family members regarding these choices. 4. Healthcare Power of Attorney This document permits the legal transfer of authority to make medical decisions on your behalf. In the event you are not able to make decisions for yourself, the designee, known as the agent, can determine what medical procedures are allowable on the your behalf. In Illinois, the Healthcare Power of Attorney also contains a section allowing you to choose from healthcare options based on quality of life versus quantity of life. The combination of a medical directive and healthcare power of attorney assures you will receive the care you desire. The medical directive serves as the blueprint for your health care decision preferences. The healthcare power of attorney gives the legal authority to effect decisions based on this blueprint. 5. Power of Attorney for Property Depending on how the document is written, this designated agent can make many financial decisions for the principal. They may include overall financial affairs, bill pay, property sale, bank safe deposit boxes, contract for services, property rental, tax audits, and more. There are four basic types of power of attorney:

Our team at The Knee Law Firm, Ltd, in Mount Prospect, Illinois, serves clients throughout the Chicagoland area. We would be happy to discuss implementing these critical documents for you in an estate plan customized to your specific circumstances.  Anyone experiencing the challenge of simultaneously caring for children and aging parents is part of the “Sandwich Generation”. If this sounds familiar, please know you are not alone. You and a growing number of our population are experiencing significant anxiety and stress as you juggle schooling and activities for your kids, your own career and increased financial expectations, family dynamics, and daily caregiver duties for aging parents. Though this is a challenging time in your life, it doesn’t have to be as impossible as it may seem. Money management and estate planning are two critical elements in creating a mutually beneficial living experience for you and your loved ones. There are also some basic steps, personally and financially, that you can take to help get you through. Personal Considerations

Financial Considerations

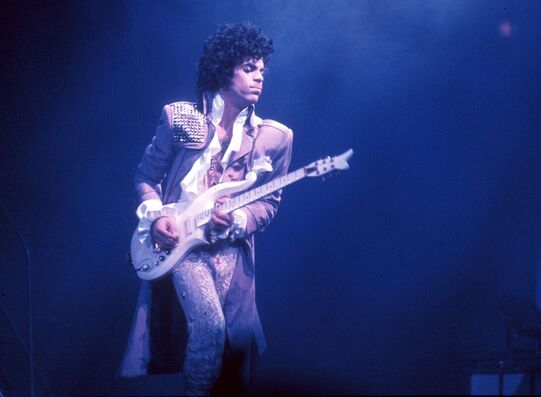

While this may not be the easiest time of your life, it is survivable and is a situation where you can all thrive with adequate planning. At The Knee Law Firm, Ltd we’re familiar with structuring these types of plans and work with many clients facing these same challenges. We would be happy to discuss your situation and how we might help.  You don't need to be rich and famous to need an effective Estate Plan. And all the money and fame in the world doesn’t always mean folks get the best estate-planning advice. Create an Estate Plan. Musician Prince never did, and because of that, even a prison inmate popped up to claim he deserved a share of Prince’s estate, worth hundreds of millions of dollars. The court battle drags on, five years after Prince’s sudden death. Billionaire Howard Hughes died without a will. Somebody found one later, but it was proved to be a fake. A court battle ensued. It took around 34 years to straighten out what should be done with his $1.5 billion. Singer Aretha Franklin died without a will. Once again – are you seeing a theme here? – her $80 million estate ended up in court. Keep your Estate-Planning documents in a safe and obvious place. Olympian athlete Florence Griffith Joyner may have had a will – somewhere – but nobody could find it. The matter ended up in court, once again, for years. The issue was whether Joyner intended her mother to live, rent-free, in the Joyners’ home. If you’re getting a divorce, don’t delay your planning. Despite that singer, Barry White and his second wife were in the process of separating at the time of his death, she ended up with his entire estate. His children from other marriages, and his live-in girlfriend at the time, all sued. The law says that until a divorce decree is signed, you are still married, and if you pass before that and your estate plan includes your soon-to-be ex, that person will get your property. Don’t try this at home. Actor Philip Seymour Hoffman didn’t like the idea of his children becoming “trust-fund kids,” so he left everything to the mother of his children, to whom he was, unfortunately, not married. The result was a tax bill of millions of dollars. This could have been avoided if he had consulted an attorney with estate-planning expertise. Don’t try this at home 2.0. Supreme Court Justice Warren Burger typed up his own short will to dispose of his $1.8 million estate. He may have known Constitutional law, but not estate planning. His family paid a huge chunk of his riches in estate taxes that, once again, could have been avoided if Justice Berger had planned correctly. If big changes happen in your life, let us know right away. Actor Heath Ledger’s outdated will left everything to his parents and sisters, but after that will was written, he had a daughter with his girlfriend. It was only by the grace of Ledger’s family that they gave the girlfriend and daughter some of Ledger’s money. Don’t rely on your family to have to make those decisions for you. Put promises in writing. Marlon Brando’s housekeeper claimed he had promised that she would get his house when he died, but he hadn't put that in writing. She sued. Three years after Brando’s death, his estate settled with her for $125,000.00. These are cautionary tales...and while your private affairs won’t necessarily end up in the newspapers...effective planning, with an Estate Planning attorney WILL prevent unnecessary expenses and legal entanglements down the road. We’d be happy to chat with you about a plan that will work for you and get the process started.

Connect with us to find out why an effective Estate Plan is important for everyone.

The last thing that you want to do is leave this world without a will. Your legacy is important, and you don’t want to leave your loved ones scrambling to sort out finances and split assets without direction. Without a will, your assets will also be split up according to the laws that govern the state in which you live. You will not have a say in where they go, and they may end up not going to the person which you want to have them. The best way to avoid a headache for your family and ensure your assets go to your loved ones is to draft a proper will with a wills and estates attorney that outlines all possible aspects and accounts for your desires. Make a plan When you want to create a will, you need to go through your life and look at everyone that may be affected by your death and has a stake in your estate. This includes examples such as your spouse, ex-spouse, children, grandchildren, siblings, and parents, though friends and other loved ones do factor in as well. These are the people who will benefit as a result of you having a properly planned out will. Once you have taken these individuals into account, you must analyze your assets. This includes personal possessions, finances, real estate, and business ventures. The value of all of your assets, once you have taken out all of the taxes, legal fees, and funeral expenses that come with passing away, you then have an idea of how much you will have to leave to your loved ones. Should you put funds into a trust? A trust is an excellent solution to help financially support minors, support charities, as well as have safeguards in place for beneficiaries. When funds are held in a trust, they are held with rules and stipulations that the person who set up the trust puts in place. For example, a cottage can be put in a trust with multiple children put on the trust as beneficiaries, but a rule can stipulate that the property cannot be sold without agreement between all parties. A trust can be a great tool to help you ensure that your loved ones are taken care of. What about minor children? If you have minor children, then you need a will that stipulates who will become their legal guardian in the event of your death. If you have a spouse or an ex-spouse, then they will retain custody, but if you are a single parent, then you need to include in your will who takes over as their guardian. If you do not include this, then your death can be even more turbulent for your children. It sounds like a lot Trying to create an Estate Plan on your own that considers everything, including the tax that your heirs may owe, is incredibly difficult. Hiring a lawyer to draft your documents and to ensure that everything is in order will take a weight off of your shoulders. Our estate planning team at The Knee Law Firm, Ltd., will be happy to meet with you to discuss how to start this important process. If the worst happens and you die without a will in place you are considered to have died "intestate." When you have a will in place then your estate, which includes your property, possessions, and other personal items, will be distributed according to the will. This is, of course, contingent on your debts being paid off as well as your funeral and burial costs. A will can be challenged in some cases and be made invalid by others, but for the most part, the instructions left in a will are followed.

When there is no will in place, your property must still be distributed. Here are the rules for which this distribution works:

As you can see, the rules for distributing an estate if the deceased does not have a will can be very complicated. It can also lead to fighting between family members and destroyed relationships. While it may seem that death is far off and preparing for it is not a pressing matter, anything can happen at any time. Being reasonably prepared for the worst is always a smart idea, and creating a will is one of the most responsible things you can do to protect your family and legacy. The team at The Knee Law Firm, Ltd. can help you establish a legally binding will that can speak for you if the worst were to happen. Estate planning can be a topic that some people would rather avoid. Dealing with your mortality is not something that most people want to do, but if something were to happen to you, and you did not have a will in place, then it can be a nightmare for those you leave behind. When penning your will there are a lot of things that must be considered, and you do not want to leave anything out that may slip your mind. Working with a family law attorney makes the process easy, as they have the knowledge needed to set up your will without any accidental omissions. Here are some of the most important things that you need to consider putting in your will.

Choose Your Executor An executor is someone that you either decide upon in advance to execute your will or someone who is appointed by a court to execute your will. An executor files the will with probate; notifies the banks, credit card companies and government agencies of the death; sets up any accounts for incoming funds and pay bills; files an inventory of the estate's assets with the court; maintains property; distributes assets; disposes of other property; and represent the estate in court. You need to talk to the executor you choose if you have selected a family member, and go over these responsibilities with them. It is also a good idea to have an alternate executor, so in case the primary executor cannot perform the duties there is a backup. Guardianship If you are a parent, this is the most important reason why you need to create a will! In the will, you can name who your children will go to in the event of your death. Whether your will dictates they go to your spouse, or in the case of both of your deaths a close relative or sibling who has reached the age of majority, having this in writing is incredibly important for the lives of those you leave behind if you die. You can also choose someone to manage your children's property if you want to leave it to them when they come of age. Assets Your assets, such as cars, property, and even special items such as a watch or specific piece of jewelry that just have to go to a particular person, need to be properly noted in a will. You have to describe the item in detail, for instance, the make and model of a car you are leaving, and the person's name that you are leaving the item to. Not every single item that you own needs to be included in the will, but be as specific as you need to avoid contention after your death. Store Your Will Safely Whether you store it in a safety deposit box or keep it in a firebox at home, make sure that your will is protected and that those who need access to it can do so. This is crucial, as the last thing anyone needs is to be scrambling and searching for your will. The best thing that you can do when you are looking to create a will is to get legal advice on how to create it so that it cannot be contested in court. The team at The Knee Law Firm, Ltd. are ready to help you with estate planning. With our team you will have the security that you need and the confidence that if the worst were to happen, everything would be taken care of. If you want to legally protect your children, spouse, and assets, and make sure your things are handled and distributed properly after you have passed away, having a will is extremely important. Although wills can get very specific in what is determined after you have passed, here are some of the more general reasons why you need to get a will as soon as possible. Decide who will take care of your children If you have children who are under the age of 18 and you pass away suddenly while not having a will, the court will choose who gets to take care of your children among your family or an appointed guardian. Having a will allows you to choose who you would trust to raise your children. Properly distribute your estate Many fights have risen after a person in their family has passed away without a will. When you don’t determine how your estate will be distributed, it is basically a free-for-all for your surviving family members. Having a will is a legally-binding contract that lets you control how your estate is distributed so everyone is aware of what they are inheriting. Avoid an extended probate process All estates must go through a probate process whether you have a will or not. If you have a will, the process will go a lot faster since the court will know how you want your estate divided. If you don’t have a will, it’s up to the judgement of the court to administer and distribute your estate without your consent, which may cause long delays. Customize your will whenever you want While you are alive, you can change your will if anything comes up like a birth, death, or divorce. You can also disinherit individuals out of your will if you need to because of a falling out with a beneficiary or family member. If you don’t have a will, your estate could find its way into the hands of somebody you don’t want to have it. Lower estate taxes Having a will allows you to minimize your estate taxes and the value of what is distributed from your estate, whether to family members or charity, will lower the value of your estate when it’s time to pay estate taxes. Donation and gifting options If you have a favourite charity you have been donating to through your life, you can set up a way to donate or gift a portion of your estate after you have passed away. Gifts up to $13,000 are exempt from estate tax, which will increase the value of your estate meaning your heirs will get more out of your estate. Gift tax exclusions can change from year to year, so make sure you are always up to date on the laws and how it works. If you are looking to write a will but don’t know where to start, let the experienced team at The Knee Law Firm, Ltd. be your guide. We can help you properly write a will to ensure that your estate is accounted for and distributed to the people you trust the most. |

|

RSS Feed

RSS Feed