SUBSTANTIAL CHANGES TO THE

|

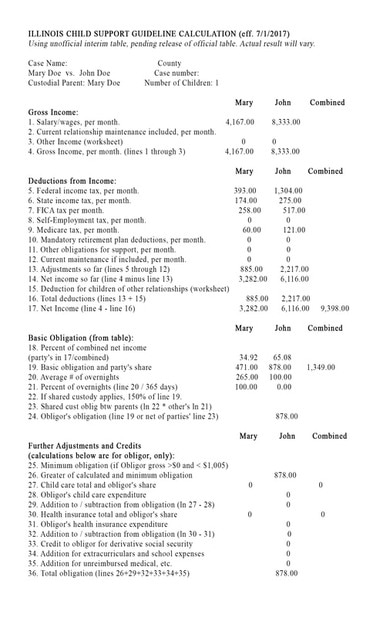

Below is an example of the calculation. Based on this scenario the parties have one child. Mom is the residential parent earning $50,000 annually. Dad earns $100,000 annually and has 100 overnights with the child.

click image to open enlarged version |